Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomTech Rout Shifts Sentiment; Inflation & BoE in Focus

Ultima Markets Daily Market Insights – December 18, 2025

Market sentiment has shifted decisively into risk-off territory following a sharp sell-off in the technology sector. Attention now turns to a heavy macro calendar, led by the delayed US CPI release, US Initial Jobless Claims, and key central bank decisions across Europe.

Market Sentiment: Tech Sector Breakdown

Global risk appetite deteriorated yesterday as the crowded “AI trade” came under renewed pressure, driven by growing concerns over the US growth outlook and stretched valuations.

The Nasdaq 100 slid 1.81%, while the S&P 500 fell 1.16%, marking its fourth consecutive daily decline. Selling pressure was concentrated in AI chipmakers and mega-cap technology stocks, as investors reassessed the sustainability of AI-related capex and earnings expectations.

This rotation out of technology signals rising caution around market concentration risk and suggests the year-end bullish narrative is losing momentum, at least in the near term.

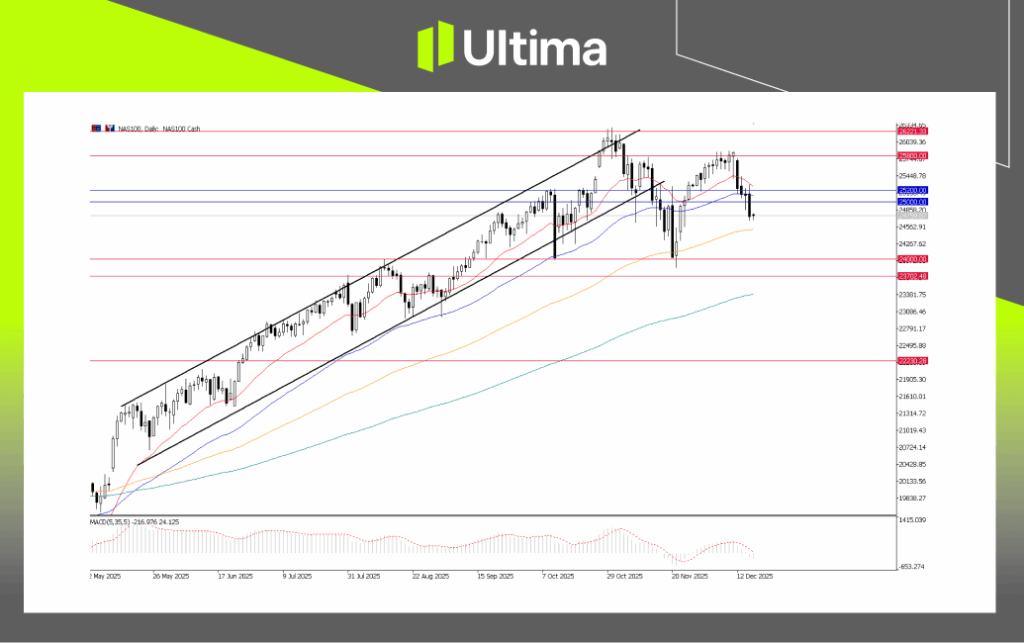

NAS100, Daily Chart | Ultima Markets MT5

Technically, with the NAS100 breaking below 25,000, a corrective downside move is likely to extend, with the next key support around 24,000. This points to a potential consolidation phase for the tech index.

US Risk Events Today: Jobless Claims & CPI Preview

With risk sentiment already fragile, volatility is expected to increase further during Thursday’s US session, driven by a “double-header” of high-impact data.

US Initial Jobless Claims

Consensus is for 229,000 new claims, slightly lower than the previous week’s 236,000. This release is particularly important given this Tuesday’s NFP and jobs reports, which raised concerns about the US labor market and growth outlook.

A higher-than-expected print (e.g., >240k) would reinforce the “cooling labor market” narrative, putting additional pressure on the Dollar.US Consumer Price Index Preview

US Consumer Price Index Preview

Undoubtedly, the focus will also be on the latest US inflation figure—November Consumer Price Index. This release is unusual because October data was missed due to the 43-day government shutdown, leaving no clean month-over-month comparison and meaning the BLS will not publish October figures.

- Forecast: Headline CPI YoY ~3.1% (up from 3.0% in September)

- Market Focus: The missing data may complicate trend interpretation, but any significant deviation from the 3.1% forecast will still drive Dollar volatility.

A softer-than-expected reading would strengthen market bets for additional Fed cuts in 2026 and reflect slowing spending, weighing on the growth outlook. Conversely, a hotter print would heighten stagflation concerns.

Volatility could be further amplified if Jobless Claims and CPI moves surprise simultaneously. This could continue to pressure on the Dollar, which lead the US Dollar Index to lose ground on the 98.00 which open up for more slide. Refer to our previous day market insights on Dollar analysis.

Bank of England Preview: Dovish Cut Expected

The Bank of England announces its interest rate decision today, making it the focal central bank event for the session.

- The Consensus: Markets are pricing in a 91.5% probability of a 25-basis-point cut to 3.75%, marking the fourth cut of 2025.

- UK Inflation: Headline inflation fell sharply to 3.2% in November (from 3.6%), giving policymakers room to ease amid a slowing economy.

- The Vote: A tight split is expected, likely 5-4 in favor of a cut, with Governor Andrew Bailey potentially casting the deciding vote. A larger majority for easing would reinforce the dovish bias.

A dovish cut is largely priced in. However, if the BoE signals caution on future 2026 cuts due to lingering service inflation, Sterling (GBP) may see a “sell the rumor, buy the fact” bounce. Conversely, more dovish messaging could extend pressure on the Pound.

Meanwhile, the ECB Governing Council also meets today. Compared with the high-drama Fed and BoE events, the ECB decision is expected to generate less volatility. Unless President Lagarde surprises with 2026 guidance, the Euro’s direction today will likely be influenced more by US CPI, Fed expectations, or BoE developments rather than the ECB itself.

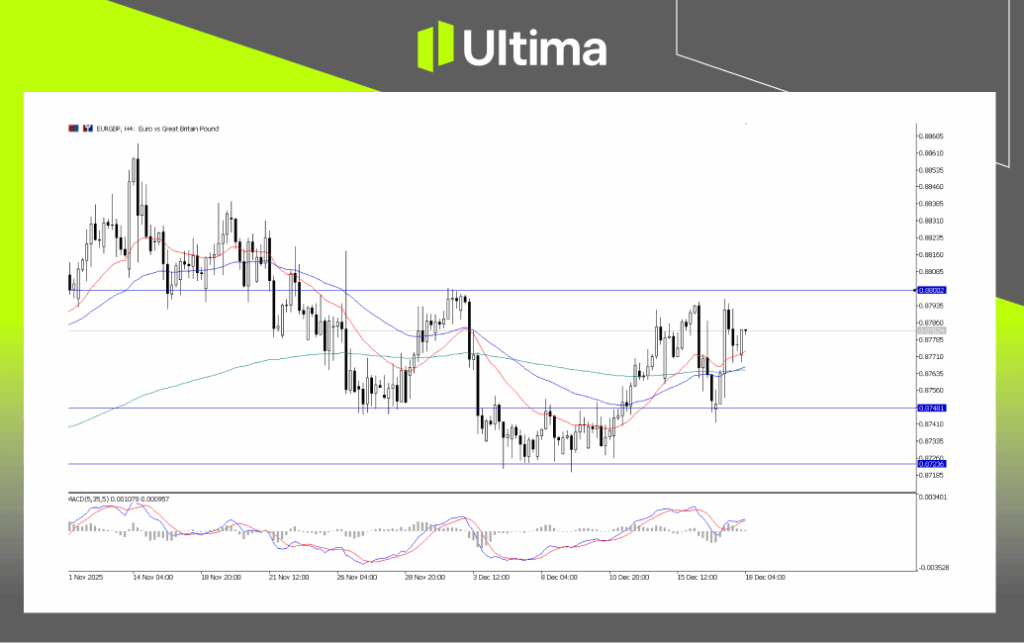

EUR/GBP, H4 Chart | Ultima Markets MT5

The divergence for both central bank would lead to the Euro favorable against the pound, especially if BoE delivered a dovish cut on later. The price actions suggest eurgbp is setting stage for a bullish reversal, meanwhile we need to see a clear above the 0.8000 key level for more decisive rally.

Daily Market Takeaways

The key focus today will be on high-impact events, which are expected to drive significant volatility into the end of the week:

- US Data – Jobless Claims & CPI: These releases are likely to dictate the next directional move for the U.S. Dollar and stock market, with potential for sharp swings depending on surprises.

- Bank of England: A dovish cut is largely priced in, but any signals on 2026 guidance will influence Sterling, either capping gains or extending downside pressure.

- European Central Bank: The ECB’s decision is expected to have limited immediate impact unless President Lagarde delivers a surprising forward guidance for 2026, in which case the Euro could react sharply.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server